Will There Soon be Surcharges for Using Credit Cards?

This is a blog explaining recent litigation settlement that will affect consumers all over the country, but Connecticut residents are exempt for now.

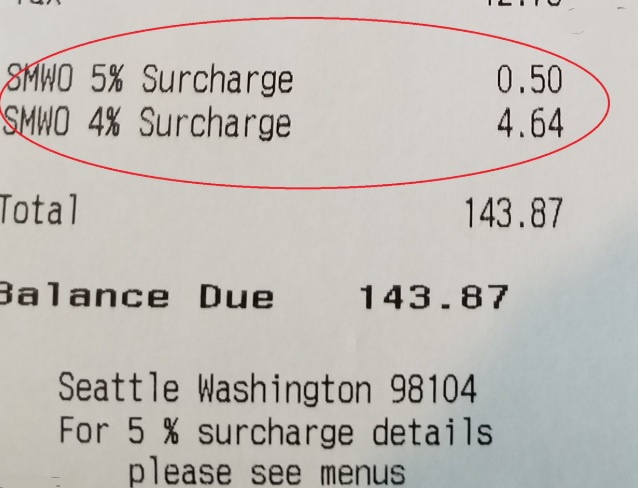

Okay, you go to your local store, grab a few products, go to the cashier and buy with your favorite credit card. But wait, as you sign the receipt, in addition to the sales tax, there's another 3% surcharge because you used your credit card. Can this really happen? I may, or it may not.

A long running litigation was finally resolved in November 2012. MasterCard, Visa, and a few big banks reached a "memorandum of understanding" to resolve claims brought by a class of U.S. retailers back in 2005 regarding the fees merchants have to pay to accept credit card transactions.

Retailers were tired as heck and weren't going to take it anymore. They had been paying those high processing fees for rewards offering sky miles and cash back. Meanwhile consumers thought those rewards just fell from the heavens.

So, beginning January 27, 2013 merchants can now legally surcharge for products purchased with a credit card (not debit cards). So, beware.

Here in the Northeast, the states of Massachusetts, Connecticut, New York and Maine (along with 6 other states) expressly forbid surcharges, so it's not going to happen here any time soon. But it could in Rhode Island where surcharges are legal.

As usual there are bureaucratic hurdles for merchants to overcome to achieve such, the most daunting is that the technology is not developed yet to impose the surcharges. So, Jan. 27th may well come and go with little consumer uproar.

How much will the surcharge be? Well, the rules state that it cannot exceed what the merchant would have to pay in fees to process the credit card transaction. That would be in the area of 2.5% - 3.25%, in no case can it exceed 4%.

Even though they won, merchants may just opt not to surcharge. Although they're currently paying for those sky miles on rewards credit cards, it's all baked into the pricing. The question remains will there be a sea change to put the onus of paying for those rewards on the recipient of such? Stay tuned.

About the Author

Al Valente is a business consultant servicing New England and helps customers to make smart investment decisions in selecting their payments processing systems. He is an independent agent for NCR/JetPay and Upserve.

|

|